About

Albulus

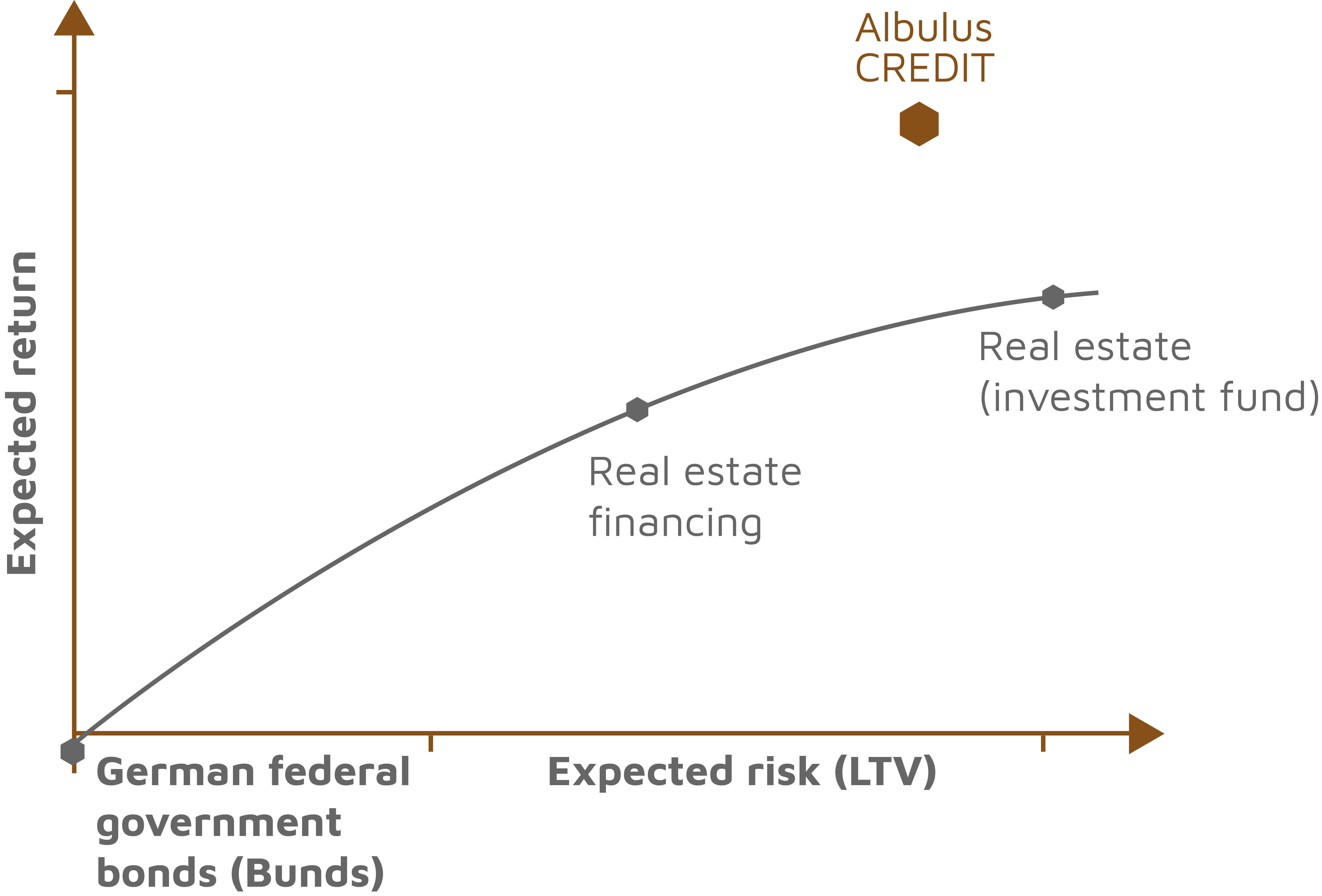

A dedicated investor specializing in German commercial real estate debt

|

As part of its distressed opportunities strategy, Albulus manages three customized investment mandates on behalf of one international and two German investors, targeting investments in nonperforming real estate loans. Since its establishment in 2011, Albulus has invested EUR 500 million equity capital in 19 successful transactions. The Albulus team has extensive expertise in the acquisition and workout of loans secured by |

commercial property in Germany. It is headed by company founder Dr. Ruprecht Hellauer and his longstanding business partners, Dr. Tobias Friedrich and Christoph Schröder. Over the past 15 years, the management team has overseen investments in real estate debt with a nominal value of more than EUR 2 billion, and has managed loan workout with a volume in excess of EUR 1.5 billion. |